Overview of Market Dynamics and Future Directions

Market Size & Growth

- According to a recent report, the global VoIP market is estimated at about USD 161.79 billion in 2025.

- Long-term forecasts remain bullish: the market is projected to grow to around USD 415.20 billion by 2034, corresponding to a compound annual growth rate (CAGR) of roughly 11.0–11.1% from 2025 onward.

- Alternative estimates for “VoIP services” specifically suggest the services segment could be worth USD 178.9 billion in 2025, with potential growth to ~USD 413.36 billion by 2032 (CAGR ~12.7%).

- Historically, the market was smaller: some older sources record global VoIP revenue in the ballpark of ~USD 132.5 billion as of 2023.

As of 2025, VoIP is not a peripheral or emerging niche — it is a multibillion-dollar, mainstream industry. The projected growth suggests that VoIP will continue to expand rapidly, likely more than doubling in global value over the coming decade.

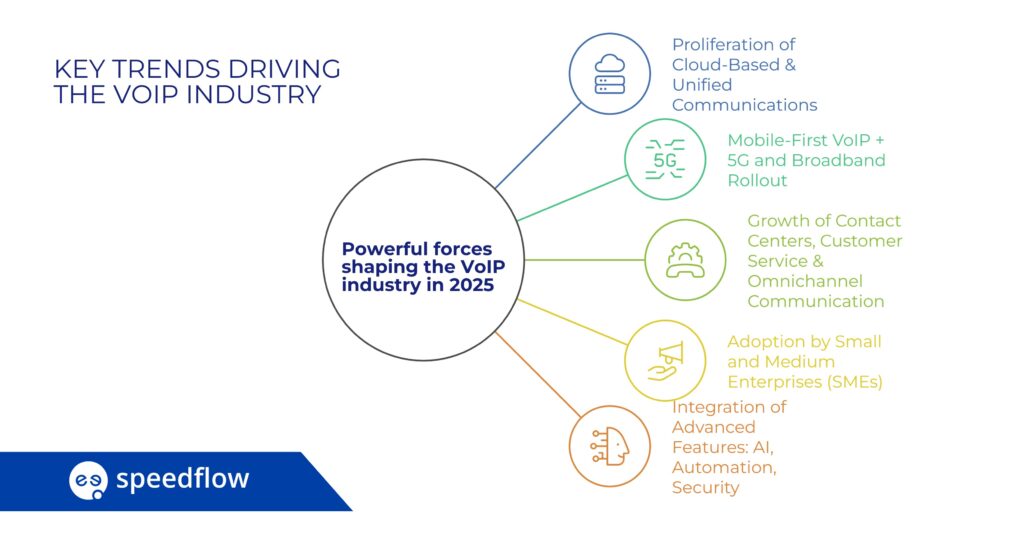

Key Trends Driving the VoIP Industry in 2025

Several powerful forces are shaping the VoIP landscape right now. Key among them:

- Proliferation of Cloud-Based & Unified Communications

VoIP increasingly sits at the heart of broader cloud-based communication stacks — combining voice, video, messaging, and collaboration. The trend toward unified-communication platforms is accelerating adoption across enterprises. Businesses are migrating away from legacy PSTN or on-premises PBX systems to hosted IP-PBX, SIP trunking, and other cloud-native VoIP solutions, appreciating the scalability, flexibility, and cost benefits.

- Mobile-First VoIP + 5G and Broadband Rollout

The rise of mobile devices, high-speed broadband, and widespread 5G adoption underpins increased use of mobile VoIP — both for personal and enterprise communications.

This shift blurs the line between “office phone system” and “personal communications,” making VoIP ubiquitous for everyday voice and video calls, and not just as a business telephony alternative.

- Growth of Contact Centers, Customer Service & Omnichannel Communication

In 2025, many businesses equipped their contact centers with modern VoIP-based infrastructure. These systems allow handling high call volumes, integrating with CRMs, enabling inbound & outbound campaigns, managing call queues, and supporting features like attended or blind transfers.

Omnichannel communication — voice, chat, video, messaging — is increasingly standard, offering customers flexibility and businesses deeper integration of their communication channels.

- Adoption by Small and Medium Enterprises (SMEs)

While large enterprises continue to dominate overall revenue share, SMEs are increasingly turning to VoIP. Cloud-based VoIP reduces capital expenditure (no need for heavy PBX hardware) and offers flexibility — a compelling value proposition for SMEs especially in a global, distributed workforce environment.

- Integration of Advanced Features: AI, Automation, Security

2025 sees growing use of AI-driven features in VoIP: smarter call routing, analytics, transcription, automated support (chatbots + voice bots), and enhanced security measures are becoming selling points for providers.

Given rising cybersecurity concerns and regulatory pressure, VoIP providers are investing in encryption, secure authentication, and fraud prevention — a critical trend for trust and compliance.

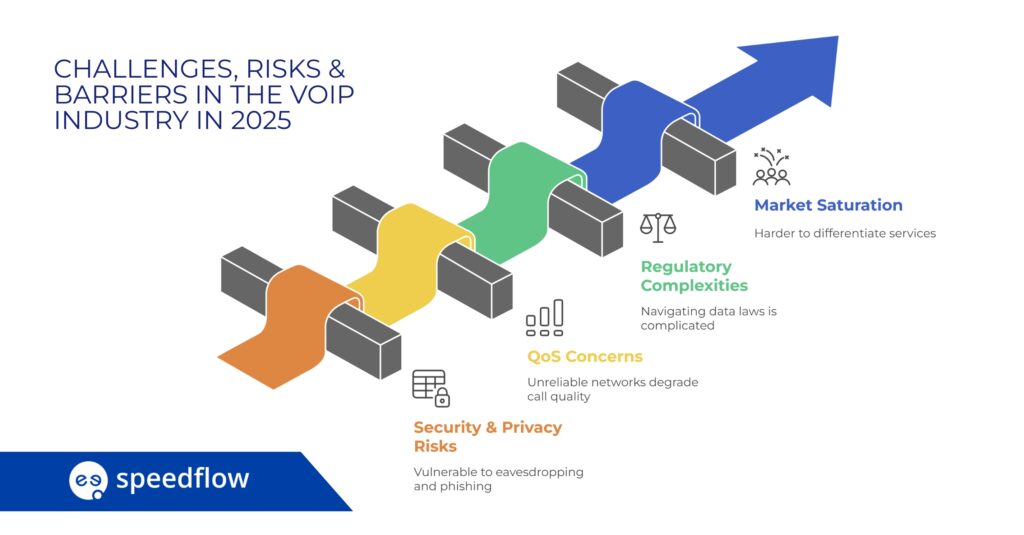

Challenges, Risks & Barriers

Even with strong growth, the VoIP industry faces nontrivial headwinds and structural challenges:

- Security & Privacy Risks: Because VoIP traffic traverses the open Internet, it remains vulnerable to problems like eavesdropping, phishing, caller-ID spoofing, and spam-over-IP (SPIT).

- Quality-of-Service (QoS) Concerns & Infrastructure Variability: In regions where broadband or mobile networks (especially high-speed/low-latency 5G) are unreliable, VoIP call quality can suffer — latency, jitter, dropped packets — which undermines user experience.

- Regulatory and Compliance Complexities: As VoIP becomes more widely used (by businesses, contact centers, international calls), services increasingly must navigate data-protection laws, lawful intercept requirements, and telecommunication regulations. This varies significantly by region, complicating global deployments.

- Competition and Market Saturation: As more players enter the space — from legacy telecoms transforming into VoIP providers, to pure-play startups — differentiation becomes harder. Providers must innovate beyond basic voice to stay competitive (e.g. through UCaaS, AI, managed services).

What to Expect: The VoIP Industry in the Coming Years (2025–2030+)

Based on current data and observed trends, several plausible future trajectories for VoIP emerge:

- VoIP as the Default Global Communication Backbone

With sustained growth — projected to exceed USD 400 billion by 2034 — VoIP is likely to become the standard for both business and personal communications globally. The shift from traditional telephony (PSTN) to all-IP infrastructure will continue accelerating, especially in regions with strong internet penetration.

- Rise of Unified Communications & Integrated Workflows

VoIP will increasingly be part of broader work-collaboration and productivity ecosystems: voice, video, messaging, file sharing, presence, CRM, and more — unified under cloud-native platforms. Organizations will treat VoIP not just as a phone system, but as part of their core digital infrastructure. This is especially true for distributed or hybrid-work organizations.

- AI, Automation, and Intelligent Communication Services

Advanced features now starting to appear — like AI-assisted call analytics, smart routing, transcription, automated attendants, AI-powered support — will become normalized. This will further distinguish VoIP from legacy telephony, and deliver new value in contact centers, customer service, and enterprise communication.

Additionally, future integration with emerging technologies (for example, leveraging high-bandwidth and low-latency networks for real-time voice + data + video + perhaps augmented / immersive communication) may transform not just “calls,” but how people collaborate live across geographies.

- Expansion into Emerging Markets & Mobile-First Use Cases

As 5G and broadband internet spread globally, VoIP adoption in emerging markets and developing regions is likely to accelerate — particularly mobile-first. This could open massive new user bases, especially in regions where traditional telephony infrastructure was weak or expensive.

- Industry Consolidation and Service Diversification

To stay competitive, VoIP providers may merge, acquire, or pivot to broader cloud-communication & managed service offerings. Standalone VoIP services may become commoditized; differentiation will come from value-added features (security, integration, AI, compliance, global reach).

Implications & What Stakeholders Should Watch

For different groups — businesses, service providers, regulators — the ongoing evolution of VoIP has important implications:

- Businesses (SMEs & large enterprises): VoIP offers cost-effective, flexible and scalable communication infrastructure. Migrating to VoIP / cloud-based PBX or unified communications can reduce costs (hardware, maintenance, long-distance calls), support remote/distributed teams, and offer richer communication tools.

- VoIP Providers: Competing on just “cheap calls” won’t suffice. Success will be increasingly determined by ability to offer secure, integrated, AI-enhanced, managed, and globally compliant services. Providers should invest in cloud infrastructure, security, and partnerships for value-added services.

- Regulators / Policymakers: As VoIP becomes more ubiquitous — and crosses borders — there will be growing need for regulation, especially related to user privacy, lawful intercept, data security, and fair access. Policymakers should anticipate and prepare for these challenges.

- Emerging Markets & Developing Regions: There’s a big opportunity for leapfrogging legacy telephony infrastructure. But success depends on broadband/5G rollout, affordability, and enabling regulatory frameworks.

Conclusion

The VoIP industry enters 2026 stronger than ever, driven by cloud adoption, mobile-first communication, and a new generation of AI-powered features that extend far beyond traditional telephony. With market forecasts pointing to sustained double-digit growth and widespread global adoption, VoIP is steadily cementing its role as the default infrastructure for business and personal communication alike. Challenges around security, regulation, and connectivity remain, but continued innovation — especially in unified communications and intelligent automation — positions the industry for another decade of expansion. As organizations modernize their communication stacks, VoIP stands at the center of a more flexible, scalable, and integrated digital future.