In 2024, the VoIP and telecom industry is really leading the way in digital transformation. Have you noticed how 5G, AI integration, and the need for budget-friendly communication options are really changing the game? It’s pretty interesting! This article takes a closer look at regional trends, the main challenges ahead, and what we can expect in the coming years, giving industry stakeholders a well-rounded overview.

2024 has been a pivotal year for Speedflow, marked by the development and launch of NexaMSG, the MediaCore SMS add-on. This cutting-edge solution embodies our dedication to innovation, enabling our clients to expand their reach through seamless and efficient SMS services. Becoming an SMS carrier-neutral company, we now proudly offer Signature SMS solutions that deliver unparalleled flexibility, quality, and global connectivity. This year, we also had the privilege of participating in one of the industry’s premier events, strengthening relationships and showcasing our advancements.

As we look ahead to 2025, Speedflow remains committed to driving technological progress and supporting our partners’ success. With a growing portfolio of telecom and SMS solutions, we’re poised to build on this year’s achievements and embrace the challenges and opportunities of the new year. Together, we’re shaping the future of telecom, SMS, and VoIP with dedication, expertise, and innovation!

Let’s talk about the industry in more detail:

Global Overview

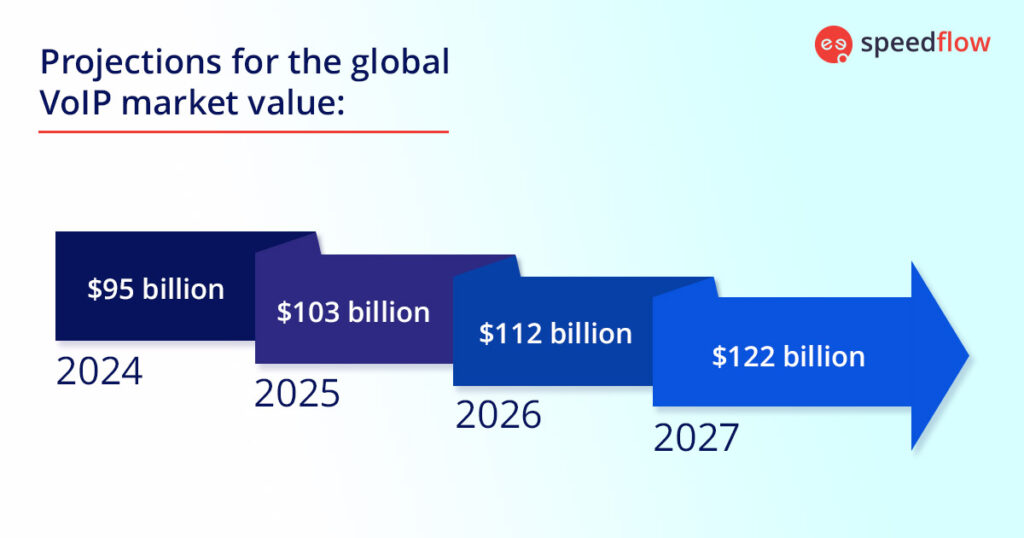

In 2024, the global VoIP market is valued at around $95 billion, and it’s projected to grow at a rate of 9.2% each year until 2027. The current transition to hybrid work environments, the growing penetration of smartphones, and the emergence of cloud-based communication platforms are driving expansion. More and more businesses and individuals are jumping on the VoIP bandwagon because it’s cost-effective, flexible, and offers great features like video conferencing and unified communications.

Regional Analysis

North America

North America’s telecom industry has seen rapid innovation since 2022. The COVID-19 pandemic accelerated the adoption of VoIP technologies, with remote work becoming a long-term norm for many industries. Businesses prioritized robust communication tools, while providers focused on integrating advanced features like virtual reality (VR) meetings and AI-powered analytics. The region has also experienced heightened investment in 5G infrastructure, with key cities becoming 5G-enabled hubs, further solidifying the demand for high-quality VoIP services.

Outlook:

North America will maintain steady growth as businesses continue to prioritize digital transformation. Cloud-based VoIP solutions are set to dominate, particularly among SMEs.

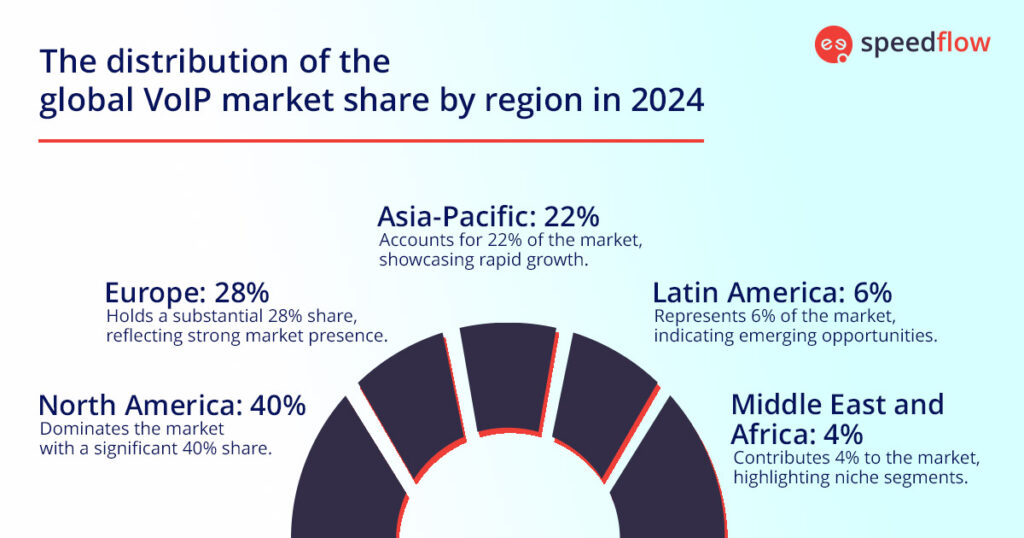

- Market Share: Leading the global VoIP market with a 40% share.

Trends:

- Proliferation of unified communication as a service (UCaaS) platforms.

- Integration of AI for personalized customer experiences and call automation.

- High adoption of 5G enabling superior VoIP performance.

Challenges:

- Data privacy concerns and compliance with evolving regulations.

- Intense competition among established providers.

Outlook: North America will maintain a steady growth as businesses continue to prioritize digital transformation. Cloud-based VoIP solutions are set to dominate, particularly among SMEs.

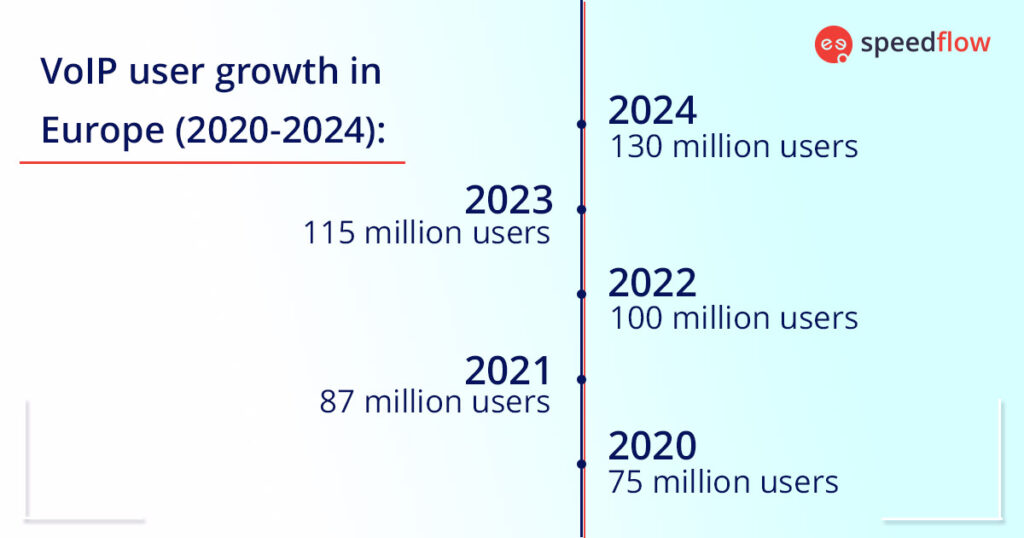

Europe: Past Two Years

Europe’s telecom landscape has undergone significant changes since 2022. The region has embraced a hybrid workforce culture, with VoIP platforms becoming essential tools for both enterprises and governments. Countries like Germany and the UK spearheaded the adoption of sustainable telecom practices, with a focus on energy-efficient operations. Meanwhile, geopolitical tensions and economic fluctuations posed challenges, but they also emphasized the need for resilient and cost-effective communication solutions.

Outlook:

With robust infrastructure and government support for digitalization, Europe will continue to play a pivotal role in the VoIP sector. Sustainability initiatives will shape telecom operations in the region.

- Market Share: Accounts for 28% of the global VoIP industry.

Trends:

- Increased reliance on VoIP for remote and hybrid work environments.

- Expansion of 5G networks, particularly in Germany, the UK, and France.

- Growing demand for multilingual VoIP solutions to support cross-border collaboration.

Challenges:

- Fragmented regulatory requirements across EU countries.

- Competition from emerging market entrants.

Outlook: With robust infrastructure and government support for digitalization, Europe will continue to play a pivotal role in the VoIP sector. Sustainability initiatives will shape telecom operations in the region.

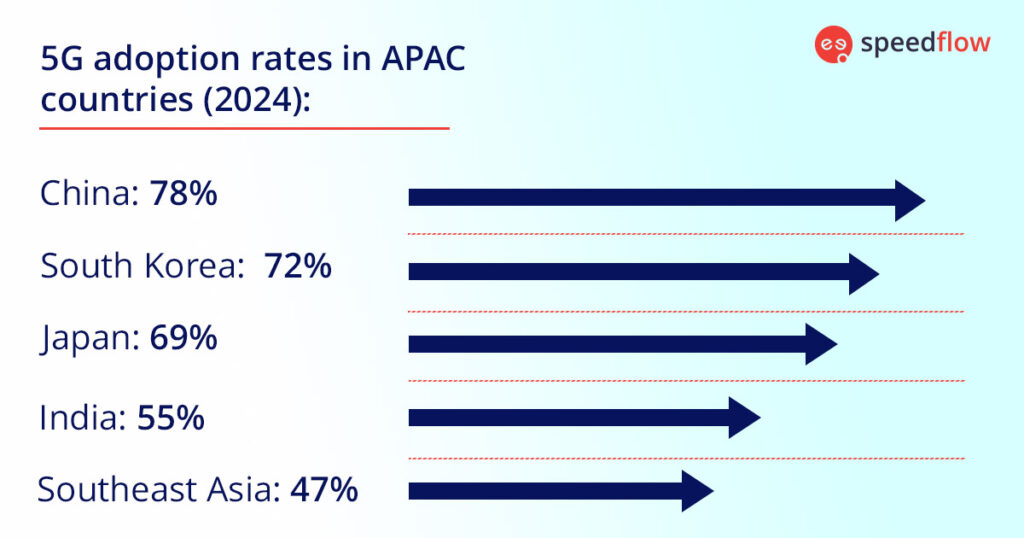

Asia-Pacific (APAC)

APAC has witnessed a remarkable growth in digital adoption since 2022. India and China, in particular, emerged as tech hubs, with startups and enterprises relying heavily on VoIP for cost-effective global communication. Japan has been at the forefront of integrating VoIP with IoT devices, creating smarter communication ecosystems. However, rural connectivity remains a persistent challenge, with governments rolling out ambitious infrastructure programs to bridge the gap.

Outlook:

Major markets like China, India, and Japan are driving growth. The rollout of 5G networks across the region will unlock new opportunities for VoIP providers, especially in enterprise communications.

- Market Share: Fastest-growing region, with an expected CAGR of 11% through 2027.

Trends:

- Rapid adoption of VoIP in business and personal communication.

- Government initiatives to expand internet access and telecom infrastructure.

- High adoption rates of mobile VoIP apps among consumers.

Challenges:

- Price sensitivity in emerging markets.

- Infrastructure gaps in rural areas.

- Outlook: Major markets like China, India, and Japan are driving growth. The rollout of 5G networks across the region will unlock new opportunities for VoIP providers, especially in enterprise communications.

Latin America

Since 2022, Latin America has shown steady progress in digital transformation, albeit with some economic hurdles. The pandemic highlighted the importance of reliable communication tools, prompting businesses to shift to VoIP platforms. Brazil and Mexico led the charge in telecom investments, focusing on expanding connectivity in underserved areas. Startups in the region increasingly turned to VoIP for affordable communication solutions, fostering innovation in customer support and collaboration tools.

Outlook:

Brazil and Mexico are poised to lead growth in the region, supported by improved telecom infrastructure and internet penetration.

- Market Share: Small but growing segment of the global market.

Trends:

- VoIP adoption by startups and SMEs for cost savings.

- Expansion of telecom networks in urban and semi-urban areas.

- Increasing use of VoIP in customer service and call centers.

Challenges:

- Economic instability in some countries is impacting investment.

- Limited internet access in remote regions.

Outlook: Brazil and Mexico are poised to lead growth in the region, supported by improved telecom infrastructure and internet penetration.

Middle East and Africa (MEA)

The MEA region has seen a mixed pace of growth in telecom since 2022. While countries like the UAE invested heavily in digital transformation and smart city projects, others faced regulatory and infrastructure challenges that slowed VoIP adoption. Urban areas have embraced mobile VoIP apps for personal and professional communication, but rural areas still lag due to limited connectivity.

Outlook:

The UAE, South Africa, and Nigeria are at the forefront of adoption. The region’s growth will hinge on regulatory reforms and the expansion of affordable telecom infrastructure.

- Market Share: Emerging market with significant potential.

Trends:

- Growing use of VoIP for cross-border communication in business.

- Investments in digital transformation by governments and private sectors.

- Increased adoption of mobile VoIP apps in urban areas.

Challenges:

- Regulatory restrictions on VoIP in certain countries.

- Dependence on international providers.

Outlook: The UAE, South Africa, and Nigeria are at the forefront of adoption. The region’s growth will hinge on regulatory reforms and the expansion of affordable telecom infrastructure.

Future Projections: 2025 and Beyond

Emerging Technologies: Integration of AI, machine learning, and blockchain will revolutionize VoIP platforms, enabling smarter and more secure communication.

5G-Driven Growth: The global expansion of 5G will enhance VoIP capabilities, reducing latency and improving call quality.

Sustainability in Telecom: The push for eco-friendly telecom solutions, such as energy-efficient data centers, will influence provider strategies.

Increased Regulation: Governments will enforce stricter compliance measures to address privacy and security concerns in VoIP services.

Expansion of Mobile VoIP: As smartphone penetration rises, mobile VoIP apps will dominate, particularly in developing regions.

Conclusion

A dynamic and ever-evolving landscape can be seen in the VoIP and telecom business in the year 2024. Despite the fact that North America and Europe continue to be at the forefront of economic development, the Asia-Pacific area is becoming an increasingly formidable growth powerhouse as a result of rapid digitalization and expanding infrastructure. Latin America and the Middle East and Africa have a lot of potential, but it all relies on whether or not they can overcome the economic and regulatory obstacles facing them.

For businesses and consumers, keeping up with these regional trends is super important for figuring out the future of communication. The VoIP industry is really set to change with all the advancements in 5G, AI, and unified communications. It’s exciting to think about how these technologies will reshape the way we connect with each other.